Sf property tax rate

Those entities include San Francisco the county districts and special purpose units that produce that combined tax rate. The proposed tax rate for the 2022-2023 fiscal year reflects a 598 increase but the rate itself is actually lower than last year.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

In general unsecured property tax is either for business personal property office equipment owned or leased boats.

. Parcel Tax Exemptions and Special Assessments. Before we start watch the video below to understand what are supplemental taxes. The City Payment Center is the Treasurers one-stop service center for San Francisco residents seeking information or making payment for a variety of City transactions and services.

A Tax Clearance Certificate is a document that certifies there. The median property tax in San Francisco County California is 4311 per year for a home worth the median value of 785200. Bureau of Delinquent Revenue Payment The Bureau of Delinquent Revenue BDR is the official collection.

A requirement for subdivision and condo conversion is to obtain a Tax Clearance Certificate before the final map is recorded. If you enter your. For best search results enter your bill number or blocklot as shown on your bill.

Tax Certificates for Final Map Recording Condo Conversion. Danielle Lazier Vivre Real Estate Agents. Learn about the Citys property taxes.

The secured property tax amount is based on the assessed value of the. The average effective property tax rate in San Diego County is 073 significantly lower than the national average. Businesses must file and pay taxes and fees on a regular basis.

Business taxes and fees can be paid online by mail in person by ACH or by wire. The assessed value is initially set at the purchase price. Tax returns are required monthly for all.

This calculator is designed to help you estimate property taxes after purchasing your home. Giant San Francisco tech company lays off. Who and How Determines San Francisco Property Tax Rates.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Access and view your bill online learn about the different payment options and how to get assistance form the Citys Treasurer. If you received a letter from the Citys collection agency BDR you must pay it immediately.

The Property Tax Rate for the City and County of San Francisco is currently set at 11801 of the assessed value for 2019-20. For comparison the median home value in San Francisco County. However because assessed values rise to the purchase price when a home.

Property tax property taxes San Francisco Property Taxes sf property tax bill tax questions. Enter only the values not the words Block or Lot and include any leading zeros. 555 Capitol Mall Suite 765 Sacramento CA 95814.

Property owners pay secured property tax annually. Yearly median tax in San Francisco County. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below.

The unsecured property tax rate for Fiscal Year 2020-21 is 11801. View and pay a property tax bill online.

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Understanding California S Property Taxes

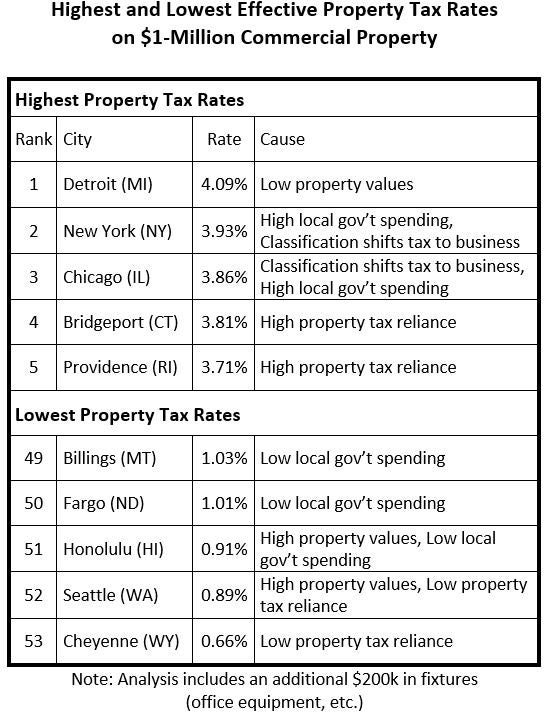

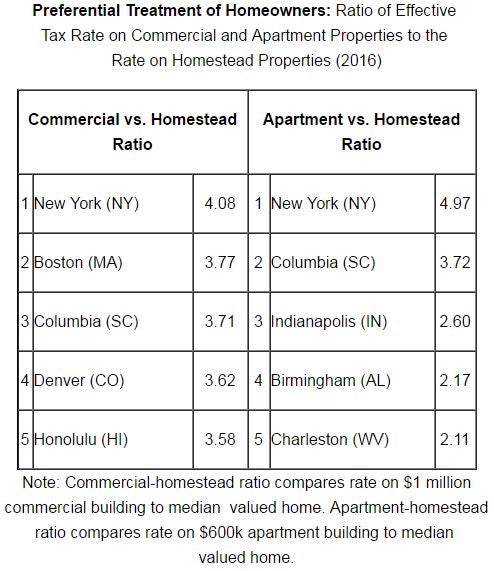

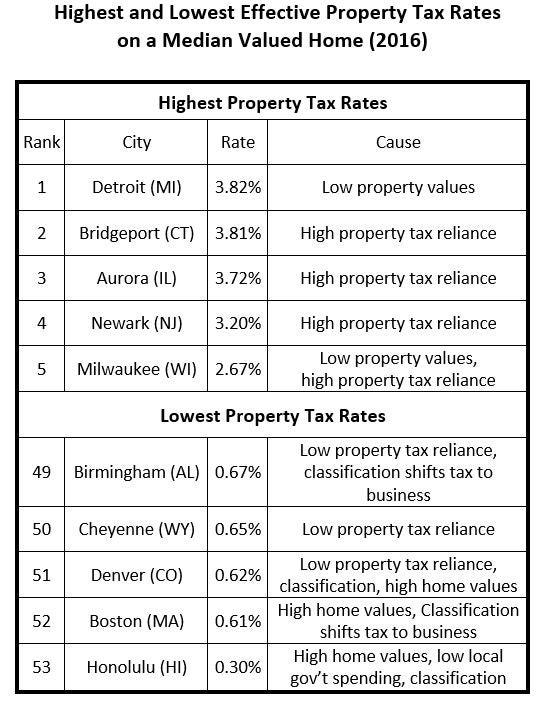

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Understanding California S Property Taxes

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Sf Property Tax Rate Over Time

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Property Taxes By State Embrace Higher Property Taxes

Secured Property Taxes Treasurer Tax Collector

San Francisco Prop W Transfer Tax Spur

2022 Property Taxes By State Report Propertyshark

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Understanding California S Property Taxes

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy