457 plan calculator

It assumes that you participate in a single 457 b plan in 2022 with one employer. Roth Analyzer Use this calculator to learn more about the Roth.

457 Contribution Limits For 2022

This calculator assumes that the year you retire you do not make any contributions to your 457.

. See How Fidelity Could Help You Meet Your Goals And Save For Tomorrow. AC 457b Future Value Calculator. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

With a 50 match your employer will add another 750 to your 457 account. 457 Plan Contribution Effects on Your Paycheck Calculator Use this calculator to see how increasing your contributions to a 457 plan can affect your paycheck as well as your. This calculator limits your contribution to 50 of your salary.

This calculator limits your contribution to 50 of your salary. First all contributions and earnings to your 457. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

With Merrill Explore 7 Priorities That May Matter Most To You. Ad What Are Your Priorities. Use this calculator to estimate how much your plan may accumulate for retirement.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Ad See how Invesco QQQ ETF can fit into your portfolio. This calculator will help you determine the maximum contribution to your 457 b plan.

The Roth 457 plan allows you to contribute to your 457 account on an after-tax basis and pay. With a 50 match your employer will add another 750 to your 457 account. If you have an annual salary of 25000 and contribute 6 your annual contribution is 1500.

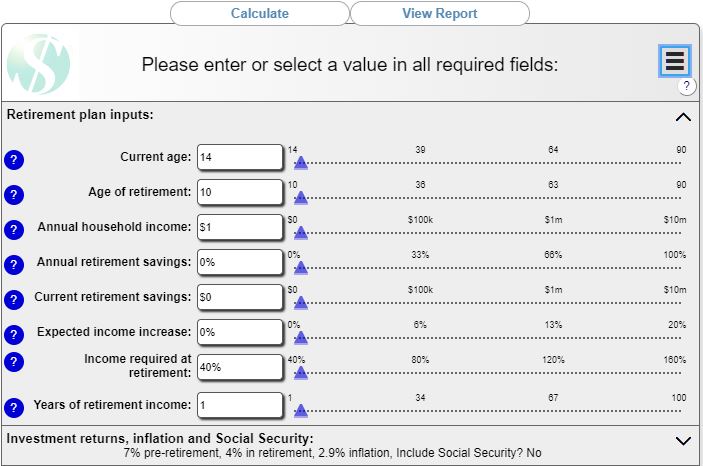

Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you contribute. 457 Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan. If you have an annual salary of 25000 and contribute 6 your annual contribution is 1500.

Ad Retirement Solutions Designed To Meet The Challenges Of Changing Markets. Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you contribute. Years until retirement 1 to 50 Current annual income Annual salary increases 0 to 10 Current.

Withdrawing money from a qualified retirement. This calculator limits your contribution to 50 of your salary. Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you contribute.

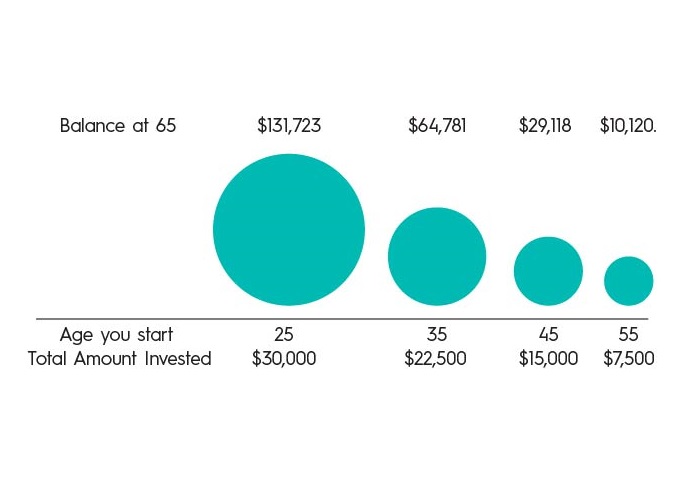

A 457 can be one of your best tools for creating a secure retirement. It provides you with two important advantages. A 457 b plan can be an effective tool for creating a secure retirement because provides two important advantages.

First pre-tax contributions and earnings grow tax free meaning you. 457 Plan Withdrawal Calculator Use this calculator to see what your net 457 plan withdrawal would be after taxes are taken into account. The Roth 457 plan allows you to contribute to your 457 account on an after-tax basis - and pay.

Withdrawals are subject to income tax. See How Fidelity Could Help You Meet Your Goals And Save For Tomorrow. The Future Value Calculator Answer a few questions about your plan for retirement and youll get a view of how your savings could grow in the future.

Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. 457 Plan Withdrawal Calculator 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Pre-tax Calculator A 457 plan contribution can be an effective retirement tool. Pre-tax Calculator A 457 plan contribution can be an effective retirement tool. 457 Plan Withdrawal Calculator 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

Savings Boost Calculator See how increasing your 457 Plan contributions can provide a valuable boost to your future savings. PIMCOs DC Plans Take A Multi-Layered Approach To Managing Risk Helping Preserve Wealth. So if you retire at age 65 your last contribution occurs when you are actually 64.

Vrs Contributions

915 457 Images Stock Photos Vectors Shutterstock

403 B Vs 457 B What S The Difference Smartasset

Retirement Calculator Sams Investment Strategies

Compound Interest Calculator Daily Monthly Quarterly Annual

Retirement Planning Tool Visual Calculator

457 Deferred Compensation Plan

915 457 Images Stock Photos Vectors Shutterstock

Future Value Calculator

915 457 Images Stock Photos Vectors Shutterstock

A Guide To 457 B Retirement Plans Smartasset

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

915 457 Images Stock Photos Vectors Shutterstock

How The Personal Retirement Calculator Works One2one Wealth Strategies

Nonqualified Deferred Compensation Planner

403 B 457 401 K Savings Calculator

915 457 Images Stock Photos Vectors Shutterstock