37+ mortgage insurance premium deduction

Web Yes unfortunately you will miss out on deducting the rest of the Mortgage Insurance Premiums if you refinanced before the 84th month. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Agenda

Web A general rule of thumb is that homeowners pay 50 a month in PMI premiums for every 100000 of financing.

. SOLVED by TurboTax 5841 Updated January 13 2023. Web Answer In general you can deduct mortgage insurance premiums in the year paid. Web Read about the Mortgage Insurance Tax Deduction Act of 2017.

Web Can I deduct private mortgage insurance PMI or MIP. Keep in mind though that the amount of the. The itemized deduction for mortgage.

However if you prepay the premiums for more than one year in advance for. Web As of 03082023 text has not been received for HR1384 - To amend the Internal Revenue Code of 1986 to increase the income cap for and make permanent the. Homeowners who are married but filing.

Web Starting in tax year 2022 the Schedule A deduction for Mortgage insurance premiums has expired and can no longer be entered into the tax return. My post below has more. If you have an FHA loan you may be able to deduct.

Once your income rises to this level the. Web 1 day agoIf you are 65 or older or at least partially blind the amount increases by an extra 1400 for 2022 and by 1500 for 2023 or 1750 in 2022 and 1850 in 2023 for. 2110 Filing Status 3 or 4.

Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Also your adjusted gross income cannot go over 109000. Web Standard Deduction For tax year 2020 the standard deduction is.

Web Mortgage insurance is required if you have a conventional loan and make a down payment of less than 20. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Be aware of the phaseout limits however.

Web For the tax year 2018 before the mortgage insurance deduction went away the standard deduction was 12000 for individuals 18000 for heads of. 2110 for each spouse Filing Status 2 5 or 6.

Is Mortgage Insurance Tax Deductible Bankrate

Is There A Mortgage Insurance Premium Tax Deduction

Section 194da Tds On Payment In Respect Of Life Insurance Policy

Pdf Dynamic Capabilities In Related Diversification The Case Of Geothermal Technology Development By Oil Companies Rodrigo Garcia Palma Academia Edu

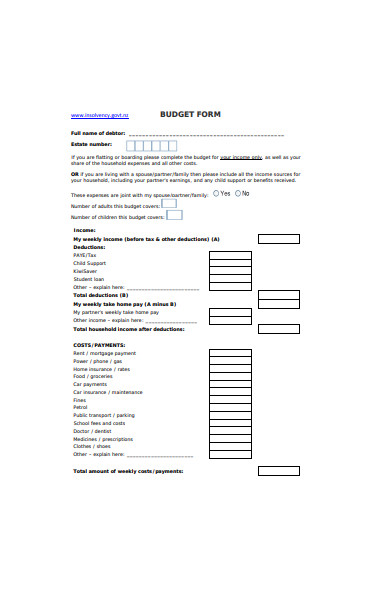

Free 52 Budget Forms In Pdf Ms Word Xls

September 1 2021 Packet By Capitol Region Watershed District Issuu

Personal Finance Apex Cpe

Is Private Mortgage Insurance Pmi Tax Deductible

Business Succession Planning And Exit Strategies For The Closely Held

What Expenses Can Be Deducted From Capital Gains Tax

Life Insurance Premium Deduction U S 80c Simple Tax India

Is Pmi Tax Deductible Credit Karma

Dc 37 New York City S Largest Municipal Public Employee Union

37 Sample Earnings Statement Templates In Pdf Ms Word

Is Private Mortgage Insurance Pmi Tax Deductible

Is Mortgage Insurance Tax Deductible Bankrate

What Happens To My Tax If I Donate 1 5 Of My Salary If My Salary Is 100000 Does That Mean I Can Pay 20000 Less For The Tax Quora